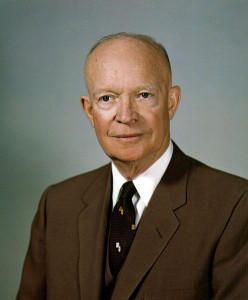

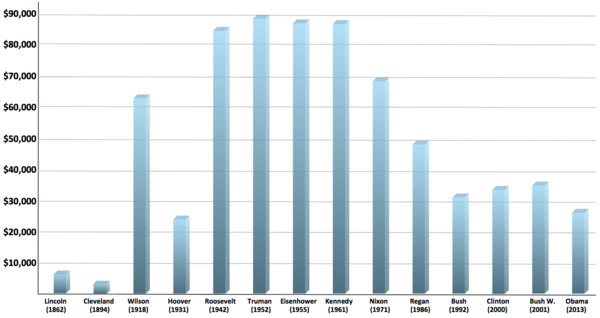

Q. How much of your hard earned money went to Income Taxes? A. In 1952 – 90%!!!

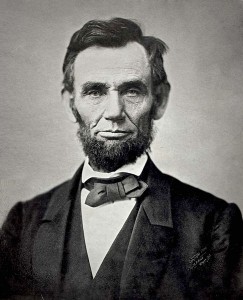

President Lincoln started the income tax to help pay for the Civil War. For a brief time, no tax was collected and then it became a standard annual tax.

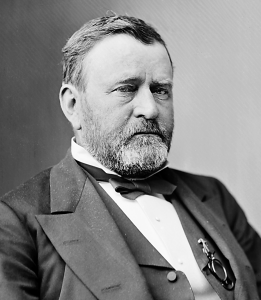

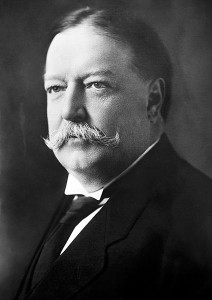

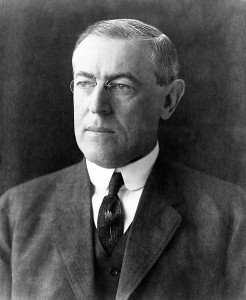

Scroll down to compare income tax rates with the sitting U.S. President at the time and see what the income tax rate was during that year.

Click on the button to the right to expand all entries for better viewing experience.

Sources:

IRS website on Historical Highlights

Tax Foundation income tax rates history